The Fund seeks to maximize profit income and capital appreciation by investing in fixed and floating rate Sukuk of Government, Government related issuers, supranational entities and corporate issuers

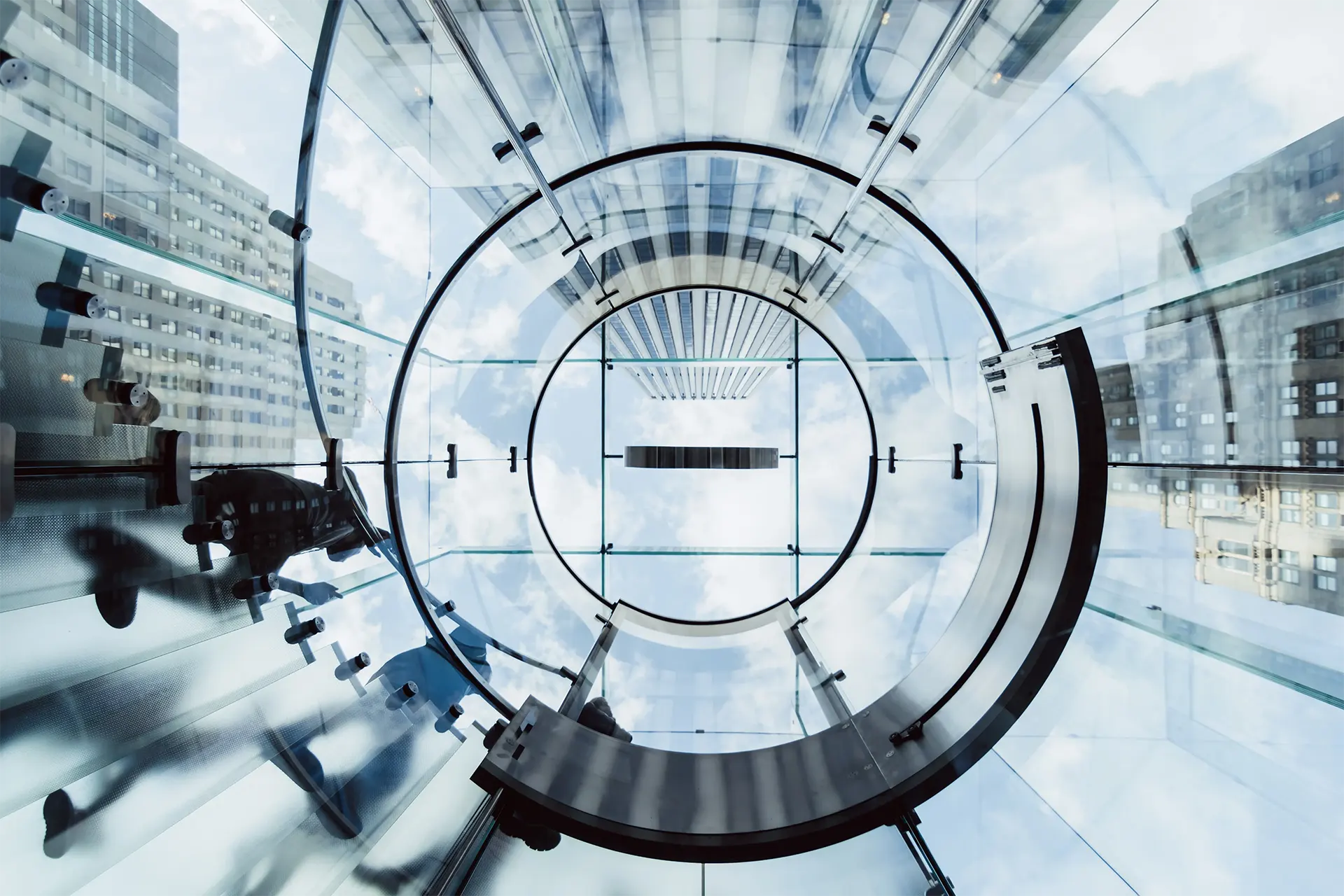

Core Solutions.

Investment Strategy

Our investment approach is guided by thorough market analysis and risk assessment to identify sukuk opportunities with attractive yields and strong issuer fundamentals. The fund’s portfolio is diversified across various sectors, geographies, and maturities to optimize risk-adjusted returns while maintaining full Shariah compliance.

Key Features

- Sharia-compliant investment structure

- Focus on capital preservation with steady income

- Professional management by experienced team

- Diversified exposure to global sukuk markets

- Regular income distribution options

- Low correlation to conventional fixed income

Fund Performance

The ASB Global Sukuk Fund aims to achieve a target return of 7% over a market cycle while maintaining lower volatility compared to conventional bond funds. Our focus on quality issuers and careful credit selection has allowed the fund to navigate various market cycles successfully.

Get in touch

Buy through your brokerage

All ASB Capital Public Funds are available through online brokerage firms

Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds' offering documents. Read the offering documents carefully before investing. Investing involves risk, including possible loss of principal.